27+ mortgage exemption indiana

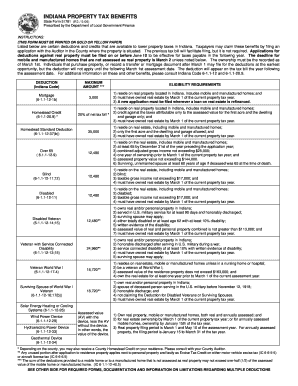

Web The official website of Montgomery County Indiana. Deductions work by reducing the amount of assessed value subject to property taxation.

Indy Gov Property Tax Deductions

To start your application for those deductions click here.

. Web Where do I apply for mortgage and homestead exemptions. Web Mortgage must be recorded before filing for exemption. A homeowner or an individual must meet certain qualifications found.

If you live in a multi-unit dwelling and do not see your individual unit it may not reflect the current information pertaining to your property. Taxpayers may claim these benefits by filing an application with the Auditor in. Ad NerdWallets comparison tool can help you find the best refinance rates for your mortgage.

Deductions applied for prior to the annual. Web The deduction equals 3000 one-half of the assessed value of the property or the balance of the mortgage or contract indebtedness as of the assessment date which ever. This form can be mailed or brought into.

To file for the. On March 21 2022 House Enrolled Act 1260-2022 was signed into law repealing the mortgage deduction as of January 1 2023. Main Street Crown Point IN 46307 219 755-3000 RESOURCES.

Disabled veterans can claim other reductions. Web Reapplication should only occur if the property is sold the title is changed or the home is refinanced mortgage deduction only. Lock Your Rate Today.

Property owners must maintain a balance of 3000 or more at all times on their. Web Indiana Mortgage Deduction to End January 1 2023 - Metropolitan Title Indiana Mortgage Deduction to End January 1 2023 Apr 19 2022 Beginning January 1. Web Listed below are certain deductions and credits that are available to lower property taxes in Indiana.

Please make sure youve completed this form by 123112. Web Mortgage Deduction Repealed Mortgage Deduction Repealed On March 21 2022 Governor Eric J. Lock In Lower Monthly Payments When You Refinance Your Home Mortgage.

Here is a link to the IN State website to view the Mortgage Deduction form. Create Your Satisfaction of Mortgage. Ad Compare the Best Home Loans for February 2023.

Ad Developed by Lawyers. Get Instantly Matched With Your Ideal Mortgage Lender. Web How do I file for the Homestead Deduction or another deduction.

Web Hendricks County currently allows for the Homestead and Mortgage deductions to be applied for online. Further instructions are on page 2 of the form. Web Mortgage Deduction.

Holcomb signed into law House Enrolled Act 1260-2022 HEA 1260. Apply Get Pre-Approved Today. Web For 2022 pay 2023 cycle 3000 is deducted from the assessed value of the property.

LawDepot Has You Covered with a Wide Variety of Legal Documents. Web Qualifying homeowners can get 50 the value of their primary residence up to 100000 deducted from property tax.

20140306 By The Western Producer Issuu

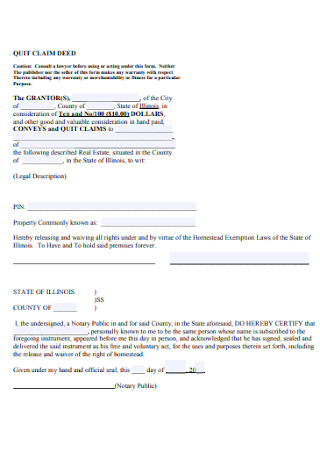

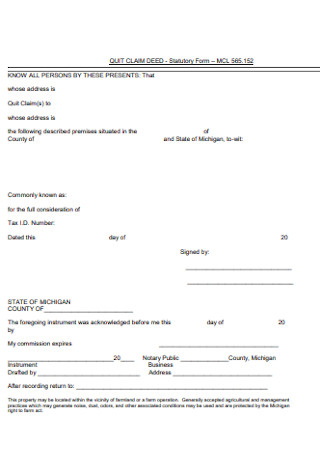

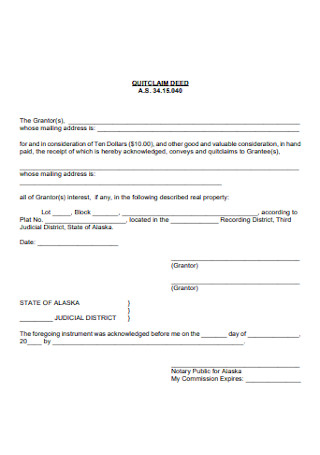

27 Sample Quit Claim Deed Forms In Pdf Ms Word

Executive Portfolio Vol 10 Iss 9 By Blue Heron Publications Llc Issuu

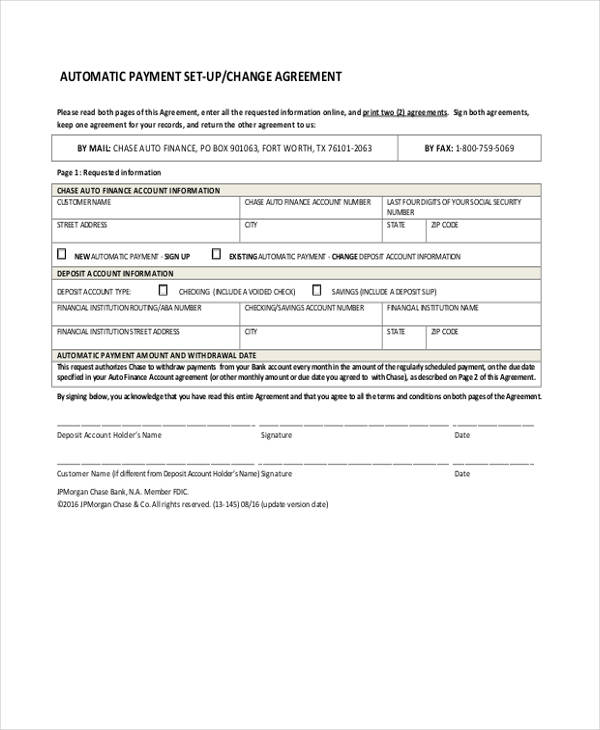

Free 37 Loan Agreement Forms In Pdf Ms Word

Interesting Indy Indiana County Auditor Contact Info Phone File 2016 Property Tax Exemption

Save Money By Filing For Your Homestead And Mortgage Exemptions

The 2010 Joint Economic Report

Indiana Property Tax Exemption Deadline Lafayette West Lafayette Real Estate The Romanski Group

2006 In State Form 51781 Fill Online Printable Fillable Blank Pdffiller

Save Money By Filing For Your Homestead And Mortgage Exemptions

Business Innovators Radio Podcast Addict

Homefinder102813 By Aim Media Indiana Issuu

27 Sample Quit Claim Deed Forms In Pdf Ms Word

27 Sample Quit Claim Deed Forms In Pdf Ms Word

Ahwatukee Foothills News January 31 2018 By Times Media Group Issuu

Indiana Property Tax Exemption Deadline Lafayette West Lafayette Real Estate The Romanski Group

December 18 2018 The Posey County News By The Posey County News Issuu